The Silver Lining: Opportunities in Aging Asia

PDF: The Silver Lining: Opportunities in Aging Asia

On this page

What is the insight?

Why is it important?

How will it impact Asia?

How will it impact Canada?

References

What is the insight?

The aging of populations in several parts of Asia is normally seen as a profound economic challenge for these societies and their governments. However, this demographic shift is catalyzing a new way of thinking about opportunities in areas such as healthcare, lifestyle management, work environments, adult education, and the rights of the elderly. Identifying these opportunities will be just as important as addressing the challenges.

These opportunities will also extend to non-Asian countries, especially to those with firms that produce product lines that cater to elderly consumers and their families. It will also include opportunities to offer services, especially from countries with welfare, social security and elderly rights systems that can be ‘exported’ and then adjusted to Asia’s varying social and economic circumstances.

Why is it important?

In advanced economies like Hong Kong, Japan, Singapore and South Korea, people aged 65 or older will account for almost 30% of those populations within the next 10-15 years. These percentages will continue to rise across most of the region. The aging of still-developing economies, including China, Indonesia and Thailand, pose similar challenges and opportunities, though on a considerably larger scale and with somewhat different dimensions. For these countries, one challenge – and opportunity – will be to manage health care costs for older citizens in order to lessen the financial strain on younger families trying to move into the middle class.

A related challenge will be to decide how to restructure national pension schemes for retired workers and how to balance expenditures on the elderly with other spending priorities. In China, even with the recent relaxation of the one-child policy, many millions of workers will be eagerly seeking ways to lessen the burden of being the sole provider of financial and emotional support for as many as two parents and four grandparents.

The demographic shift is being exacerbated in some places by the combination of migration patterns and rules and norms regarding retirement age. For example, it has been a common practice for younger members of many Asian societies to leave their hometowns for larger metropolitan hubs where education and business opportunities are more abundant. In doing so, they often leave behind older family members. Because many of these same societies have inadequate or no social security, these older citizens are left with very fragile, if any, support systems. As a result, poverty among senior citizens in countries like South Korea has reached 45 percent. This calls for massive changes in government, business and social attitudes to uncover opportunities, rather than challenges, from aging populations.

How will it impact Asia?

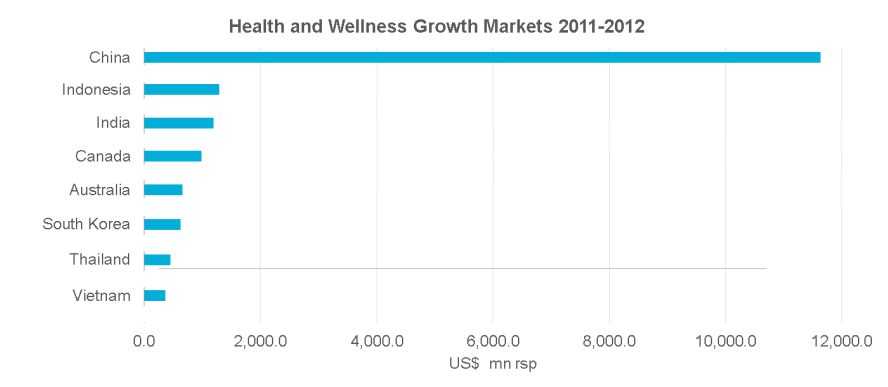

Aging populations in Asia have already impacted the health and wellness industries. In 2011, China alone contributed almost US$12 billion, or 25%, to global growth in these industries, a number that is expected to grow. Drug makers and healthcare providers are also likely to experience rapid growth. Japan is already the world’s second largest pharmaceutical market (behind the United States), but China is set to overtake that position by as early as 2016. The growing middle class is also demanding better healthcare services for the elderly, which will spur the development of hospitals and retirement homes. This may also give rise to specialized housing built for seniors, such as the Golden Jasmine residence in Singapore (video(link is external)), along with more resources devoted to community programs and centres.

Increasingly, companies in Asia will need to re-think business models to take into consideration the needs and demands of an aging work force. Reforms under consideration include allowing older employees to work part-time or from home, as well as providing occupational retraining and educational upgrading to support older workers and help them keep up with technological changes. A shifting business model will create opportunities for companies to develop technological products and services geared towards the older population. Cell phones, online shopping, delivery apps, oversized electronics and tech products can allow older populations to remain productive and independent. In Japan, the 7-Eleven chain provides free home delivery to the elderly and, as a result, 35% of convenience store customers are now seniors.

A secondary effect of aging populations in Asia – and an opportunity for those countries that still have young populations – is that the number of workers available and willing to do labour-intensive jobs, such as manufacturing, will shrink. Japanese and Korean firms have already moved operations to Southeast Asian countries like Vietnam and Indonesia. As China transitions away from a manufacturing-based economy with pools of labourers willing to work for relatively low wages, countries like the Philippines and Bangladesh will benefit.

Watch a video (link is external) of the Golden Jasmine residence in Singapore.

Figure 1: Health and Wellness Growth Markets 2011-2012

This image illustrates ‘Health and Wellness Growth Markets 2011-2012.’ China is well advance while all others are very close (Indonesia, India, Canada, Australia, S. Korea, Thailand, and Vietnam).

Source: Euromonitor International

How will it impact Canada?

The boom in the healthcare industry will produce opportunities for Canadian companies to sell well-being products and services to Asia (see Figure 1). This includes, for example, vitamins and minerals, fitness and sports equipment, and training and services tailored to older populations.

More families in Asia will also be willing to pay for long-term care insurance as their incomes rise. This is a new type of service in Asia, and one for which Canadian companies would be well-placed to provide. For example, Canadian insurance company Manulife Financial is already launching insurance products to cater to elderly populations in Asia.

Asia has very weak social security policies, but will quickly need to establish new ones in order to support its rapidly aging populations. Canada’s experience in setting up such welfare systems and reforming them in response to changing needs can be used as a model for healthcare, pension plans, retirement homes, senior services and continuing education.

References

“Health and Wellness the Trillion Dollar Industry in 2017: Key Research Highlights.(link is external)” Euromonitor International, 29 Nov. 2012.

Kang, Chan-koo. “An aging society also has benefits.(link is external)” Korea Joongang Daily, 10 Oct. 2013.

Kochien, James. “Photo/Interview: ‘Grandmother Power’ and the Challenges of an Aging Asia.(link is external)” The Asia Society, 27 Sep. 2013.

Naidu-Ghelani, Rajeshni. “Eight Ways to Invest in Aging Asia.(link is external)” CNBC, 25 Oct. 2012.

“No country for old men.(link is external)” The Korea Times, 3 Oct. 2013.

Ordinario, Cai U. “Aging Asia to benefit PH – WB.(link is external)” ABS-CBN News, 10 Oct. 2013.

Shobert, Benjamin. “Today’s Best Business Opportunity: Global Aging.(link is external)” Forbes, 3 Oct. 2013.

“Singapore’s aging population: An economic opportunity worth trillions of dollars.(link is external)” CCTV, 29 Aug. 2013.

Von der Leyen, Ursula. “Demographic Shifts: We Must Work Differently.(link is external)” The Huffington Post, 10 Oct. 2013.

Wu, Jeffrey. “Asia to lead growth in global pharmaceutical market: consultancy.(link is external)” Focus Taiwan, 17 Jul. 2013.