E-commerce in Asia: Growth of the Online Marketplace

PDF: E-commerce in Asia: Growth of the Online Marketplace

On this page

What is the insight?

Why is it important?

How will it impact Asia?

How will it impact Canada?

Interesting Facts

References

What is the insight?

In Asia, the rapid development of the e-commerce industry has been enabled by the increasing consumption of a burgeoning middle class and greater access to the Internet. Globally most e-commerce is comprised of business-to-business (B2B) exchanges. In Asia, however, online retailing is comprised of business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions. In East Asia, online marketplaces – Alibaba’s Taobao and Tmall in China, Rakuten and Yahoo in Japan, and eBay’s Gmarket and Auction in South Korea – are dominating online retailing and are emerging as a major source of economic growth. Their increasing role in facilitating consumption and innovation makes these marketplaces key players in the future of regional economic integration through e-commerce. Online marketplaces are not only changing how retailers and consumers sell and purchase goods, but are challenging traditional models of growth.

Why is it important?

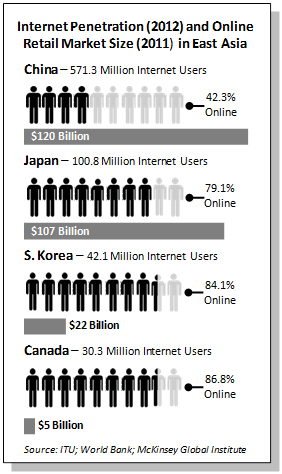

In East Asia, online retailing as part of the broader Internet economy is having a significant impact on GDP growth. In 2011, the online retailing market in China, Japan, and South Korea amounted to US$120 billion, US$107 billion, and US$22 billion, respectively (figure 1). Most of this originated from online marketplace sales. The expansion of the industry coincides with bold domestic policies that focus on deriving growth through more “creative” economies in the region.

Online retail is important because it is changing how consumers purchase goods and how retailers sell these goods and provide retail space. Compared to traditional brick-and-mortar retail outlets, online marketplaces can offer lower prices for goods because they do not require a physical store to display products. In East Asia, where population densities are high and affordable real estate is limited, this has driven sellers online to provide a wide variety of merchandise, from groceries to apparel.

However, there are many hurdles to maintaining a healthy online retail economy. Online retail is heavily dependent on digital connectivity. Although ICT (information and communications technology) infrastructure has proliferated in developed economies such as Japan, South Korea, and Singapore, emerging economies are still catching up in terms of their Internet penetration rates, 3G+ mobile service coverage, and smartphone adoption (figure 1). This has prevented them from reaping the social and economic benefits that come with a robust e-commerce industry.

In addition to ICT, transportation and delivery services are critical components of online retailing infrastructure. Timely delivery of purchases, when many consumers demand same-day delivery, is imperative for online marketplaces so that they can offer a service comparable or better to brick-and-mortal stores.

How will it impact Asia?

The rise of online marketplaces will dramatically affect the future of retail business in Asia. As ICT, transportation, and delivery infrastructure continue to improve, there will be a shift from physical stores to increasing warehouse capacity. Goods and services that were previously unavailable in rural areas due to lack of demand will become more attainable. This could lead developing regions that are more digitally connected to ‘leap-frog’ to a more dynamic online retail model. The implications for emerging markets, especially in Southeast Asian economies with a growing number of Internet users, are profound.

Online marketplaces are also helping to facilitate the growth of SMEs. Often for nominal membership and royalty fees, SMEs can gain access to a larger consumer base to sell their goods and services. In China, the number of SMEs using online marketplaces surpassed 17 million in 2012. This is also helped by the support some online marketplaces give to SMEs. For example, in South Korea, eBay’s Cross-Border Trade program assists SMEs to export globally.

As the use of online marketplaces becomes more ubiquitous, companies are branching into new types of services. Rakuten in Japan has been offering banking services and life insurance since 2000 and 2008, respectively. Alibaba in China is providing customers escrow services through Alipay and recently wealth management services through an alliance with China Minsheng Banking Corp.

The development of online retail, however, does not mean the demise of physical stores in Asia. In fact, many businesses are adapting their retail spaces to fit the lifestyles of their customers. In 2011, Seolleung subway station located in Seoul featured the first virtual storefront. Passengers were able to buy groceries by scanning QR (Quick Response) codes for each good with their mobile devices. Purchased items were delivered to their homes later in the evening (video(link is external)).

Figure 1: Internet Penetration (2012) and Online Retail Market Size (2011) in East Asia

This image illustrates the ‘Internet Penetration (2012) and Online Retail Market Size (2011) in East Asia.

How will it impact Canada?

In many ways Asia is a leading innovator of online retailing and a testing ground for new types of services. For example, after the virtual shopping centre was set up in Seoul, similar virtual showcases started appearing across the world, even in Toronto’s rail transportation hub, Union Centre (video(link is external)).

Asia’s online marketplaces are expanding their operations internationally. The key to attracting more Canadian consumers will be to integrate greater language support into their websites, as well as to provide cheaper and more efficient international shipping. In South Korea, initiatives like eBay’s Global Export Platform are assisting domestic small businesses by translating their products’ information into other languages and registering them for overseas sales (video(link is external)). This means Canadians will have more opportunities to buy local Korean goods that are normally not featured in international online marketplaces.

Some countries are introducing new international parcel delivery services specifically targeting online marketplace users. For example, in 2012, Japan Post started offering an international delivery service for online auctions that is 20 to 40 % cheaper than the traditional international express mail service. This creates a greater incentive for Canadians to buy online products from Asia that were previously unavailable or that they would normally get from other sources.

Ultimately, the next major innovation for online retail is for Asian-based online marketplaces to feature foreign sellers. While large multinational corporations like eBay, Yahoo, and Amazon already allow Asian consumers access to internationally shipped goods, Asia’s online marketplaces have yet to capitalize on this. This would create an avenue for Canadian SMEs to gain access to a larger consumer base and sell their local products across the region. This is the final, integral step for Asia’s online marketplaces to make a challenge for global online retail dominance.

Interesting Facts

In October 2013, Yahoo Japan’s Masayoshi Son announced a new strategy for e-commerce business that would eliminate all membership fees and royalties for merchants in Yahoo’s online marketplace. This policy makes it free to sell items on Yahoo Auctions and looks to challenge Rakuten, which still uses a fee and royalty system, as the most popular online marketplace in Japan.

A recent McKinsey Global Institute study shows Myanmar needs US$50 billion to upgrade its telecommunications infrastructure to leapfrog stages of development. Currently, the World Bank lists Myanmar as the third lowest in terms of Internet penetration and fourth lowest in mobile penetration, among the countries it covers.

For China, November 11th or “Double 11” has become the busiest day for online retail. In 2013, during the first hour of sales, Taobao and Tmall’s mobile sites handled US$164 million in transactions – more than their total sales on November 11 last year.

China’s biggest e-commerce company, Alibaba Group Holding Ltd., plans to quintuple the number of college graduates it hires to 1,000, and may offer them as much as three times 2012’s average pay.

References

AFP-Jiji. “Rakuten defends charges.(link is external)” Japan Times, 22 Oct. 2013.

Avery, Nerys and Sarah Chen. “China Leaders to Start Reform Summit as Economy Recovers.(link is external)” Bloomberg News, 03 Nov. 2013.

Baily, Martin N. and Richard Dobbs. “Is it a good time to invest in Myanmar?(link is external)” The Korea Herald, 10 June 2013.

Bethlahmy, Joanne and Paul Schottmiller. “Global E-Commerce: Advanced Multichannel Expectations in Highly Developed Markets.(link is external)” Point of View. San Jose: Cisco Internet Business Solutions Group, Dec. 2011.

Deng, Shasha. “China’s online sales surge in 2012.(link is external)“Xinhua News Agency, 28 March 2013.

Dobbs, Richard et al. China’s e-tail revolution(link is external). New York: McKinsey Global Institute, March 2013.

Han, Wei, Wenjiao Cao and Huiling Li. “On ‘Double 11’ Day, Alibaba and Others See Exponential Growth in E-Sales.(link is external)” Caixin Online, 11 Nov. 2013.

He, Wei. “Alibaba forms partnership with Minsheng Bank.(link is external)” China Daily, 16 Sept. 2013.

International Telecommunications Union(link is external). Percentage of individuals using the Internet. 2012.

Kim, So-hyun. “eBay Korea backs small business exports.(link is external)” The Korea Herald, 25 April 2013.

Kim, Young-won. “Science minister, eBay CEO discuss online commerce.(link is external)” The Korea Herald, 08 Oct. 2013.

Kyodo. “Discount overseas parcel service eyed.(link is external)” Japan Times, 07 March 2012.

Lee, Won-joon. “Executives face rising demand for digital mindset.(link is external)” The Korea Herald, 01 Oct. 2013.

Norioka, Kosaku. “‘E-tailing’ reshaping Japan property business(link is external).” The Wall Street Journal, 22 July 2013.

Salsberg, Brian and Yuka Morita. “Online retail in Japan: Too late for new entrants?(link is external)” Consumer and Shopper Insights. New York: McKinsey & Company, July 2012.